Charitable Trusts

Including the AGC Education and Research Foundation in your long-term financial planning through a charitable trust is a meaningful way to leave a legacy that supports the construction industry. Depending on your personal financial goals and circumstances, there are several types of trusts available that offer flexibility and tax benefits. Charitable trusts are designed to be income tax-exempt and can benefit both your loved ones and the charitable organizations you support. There are two primary categories of charitable trusts, each with its own variations:

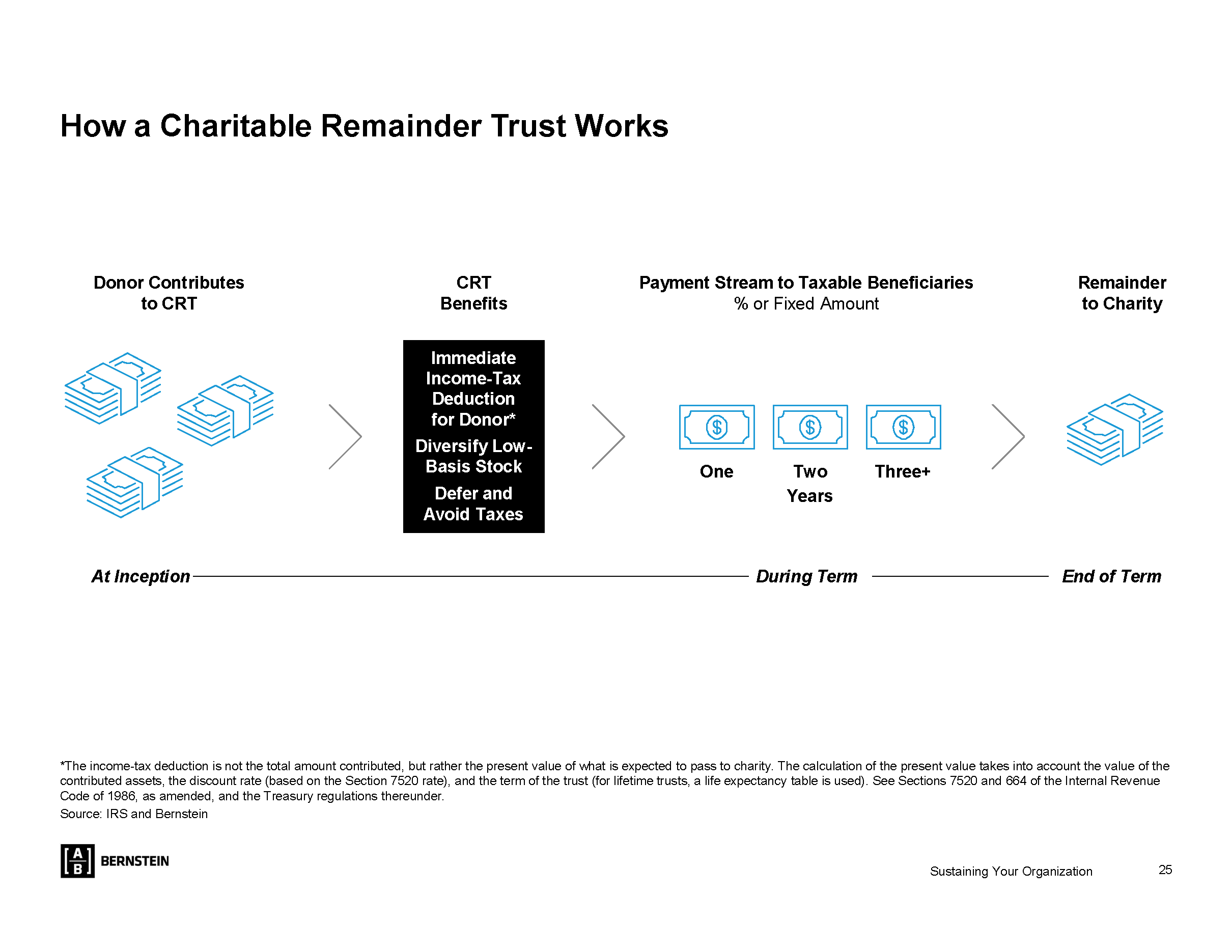

Charitable Remainder Trust (CRT)

A Charitable Remainder Trust allows you or designated beneficiaries to receive regular income for life or a specified term of up to 20 years. After this period ends, any remaining assets in the trust are donated to the AGC Education and Research Foundation. CRTs come in two main formats, each offering distinct advantages:

- Charitable Remainder Annuity Trust: Pays a fixed annual amount, regardless of changes in the trust’s investment performance. Your payments remain consistent year after year.

- Key Benefits:

- Potential for an immediate income tax deduction on a portion of your gift.

- Possible deferral or elimination of capital gains taxes on appreciated assets contributed to the trust.

- Provides reliable income to you or your beneficiaries for life or for a set number of years.

- Key Benefits:

- Charitable Remainder Unitrust: Works in a very similar way, but it pays you at a variable rate each year based on a fixed percentage of the fair market value of the trust assets. Your trust’s assets will be valued on an annual basis to determine the amount you will receive. If the trust’s assets increase, the payments to you or your beneficiaries will increase, and vice versa.

- Key Benefits

- May receive an immediate income tax deduction for a portion of your

contribution to your trust. - Can bypass or defer capital gains tax on any appreciated assets you donate.

- You or your designated beneficiaries receive income for life or a term of

years. - You can make additional gifts to the trust as your circumstances allow and may qualify for additional tax deductions.

- May receive an immediate income tax deduction for a portion of your

- Key Benefits

CRT Example: Helen, age 70, owns the same appreciated Apple stock as George but she feels that she cannot give it outright because she needs to invest for retirement income. By putting $100,000 worth of stock into a charitable remainder trust, she avoids all the capital gains tax, gets a tax deduction in the year she sets up the trust), and has an income of at least $5,000 per year for the rest of her life with a good possibility of increased income as the trust grows in value.

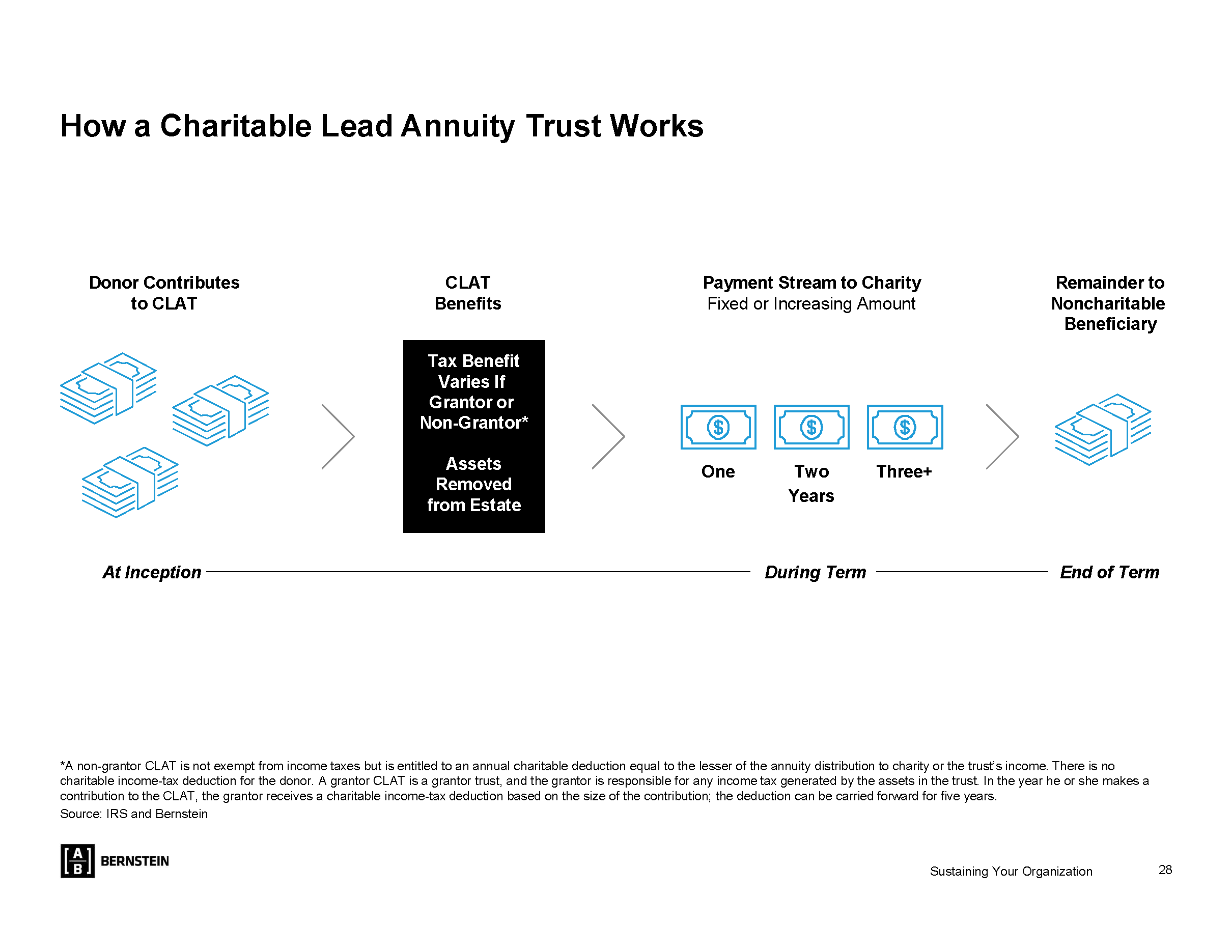

Charitable Lead Trust (CLT)

With a Charitable Lead Trust, you can support the AGC Foundation now and pass assets to your heirs later. This trust works in the opposite way of a CRT: the Foundation receives income from the trust for a set term, after which the remaining assets are transferred to your chosen beneficiaries.

There are two types of CLTs:

- Charitable Lead Annuity Trust: Distributes a fixed amount each year to the AGC Foundation.

- Charitable Lead Unitrust: Pays a varying amount annually based on the trust's asset value. If the trust grows in value, the annual payment to the Foundation increases.

Key Benefits

- May reduce or eliminate gift and estate taxes on the transfer of assets to your heirs.

- All growth within the trust passes to your beneficiaries tax-free.

- Can leverage your estate tax exemption to further decrease potential tax liabilities.

CLT Example: Adam owns an office building that he built some years ago for $1M. Renting regularly to doctors’ offices, Adam knows the building (now worth $5M) produces a steady income and is likely to appreciate still further in the future. Adam would like to give the building eventually to his two children. By placing the building in a charitable lead trust, Adam can make a substantial annual gift to the AGC Foundation for a set period of years, while, at the same time he can transfer the building to his children with no gift or estate tax, no matter how much the building will be worth in the future.

Want to Learn More?

If you’re interested in exploring how a charitable trust can align with your financial goals while supporting the future of construction, we’re here to help. Contact us at 703-837-5340 or email keith.dillon@agc.org.