Key Characteristics of Public-Private Partnerships (PPPs)

There is no single definition of a P3. The Government Accountability Office defines a public-private partnership as “a contractual arrangement that is formed between public and private-sector partners. These arrangements typically involve a government agency contracting with a private partner to renovate, construct, operate, maintain, and/or manage a facility or system, in whole or in part, that provides a public service. Under these arrangements, the agency may retain ownership of the public facility or system, but the private party generally invests its own capital to design and develop the properties. Typically, each partner shares in income resulting from the partnership. Such a venture, although a contractual arrangement, differs from typical service contracting in that the private-sector partner usually makes a substantial cash, at-risk, equity investment in the project, and the public sector gains access to new revenue or service delivery capacity without having to pay the private-sector partner.”[1]

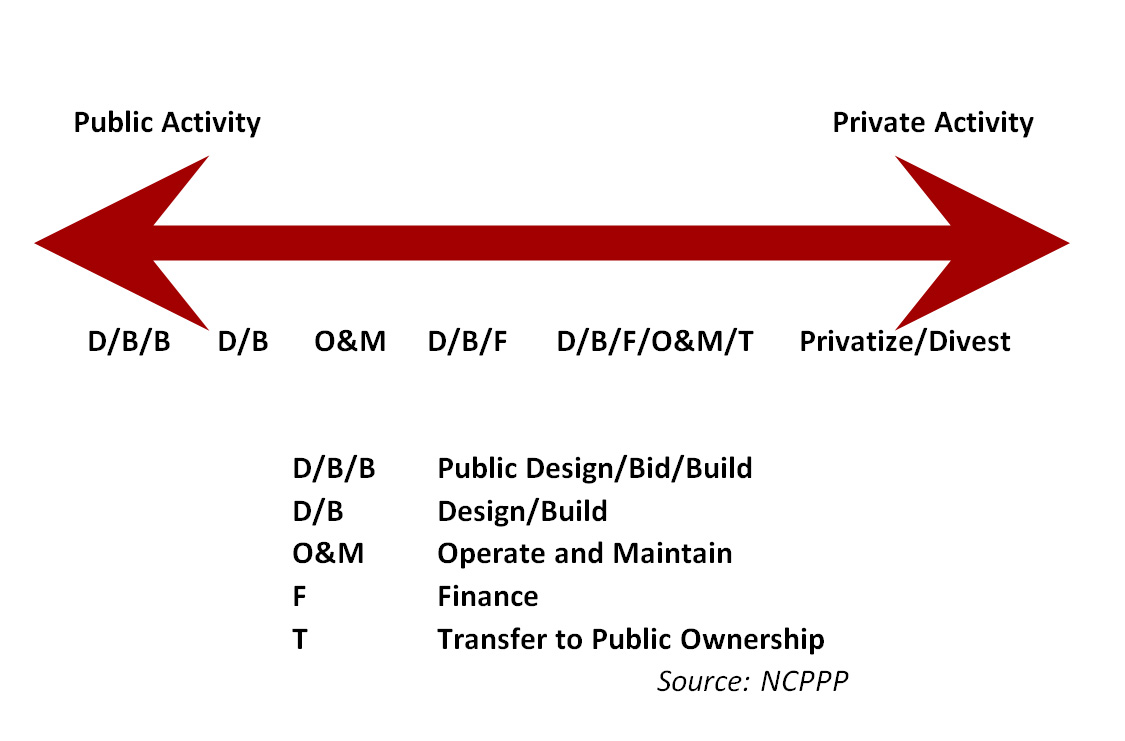

The National Council for Public-Private Partnerships (NCPPP) defines a public-private partnership as "a contractual agreement between a public agency (federal, state, or local) and a private sector entity. Through this agreement, the skills and assets of each sector (public and private) are shared in delivering a service or facility for the use of the general public. In addition to the sharing of resources, each party shares in the risks and rewards potential in the delivery of the service and/or facility."[2]

Range of P3 Projects

Types of P3s

PPPs come in many different shapes and sizes. They include both existing facilities, referred to as "brownfields," and new-capacity facilities known as "greenfield" projects.

One commonality among the different types of PPPs is a need for a dedicated revenue stream. Often the private entity will provide all or some of the upfront funding for the building or improving of a facility, but there must be a method of repayment over the duration of the partnership. The revenue stream can be derived from a number of different sources, including fees, tolls, shadow tolls, availability payments, and local taxation.

PPPs change the nature of public works construction. Instead of working for a government agency, a contractor finds him or herself working for a private entity or consortium of private firms. Such an "owner" typically has much more flexibility than a government agency. The private entity is typically free to select or create a project delivery system that fits its particular needs, and, in the process of doing so, may well request the construction contractor to expand its role beyond what the contractor has traditionally played in public works construction. Such an owner may select the Design-Build delivery system, or CM Agency, or CM At-Risk, and without going that far, the owner may still request a range of individual services that increase the contractor's risk of "professional" liability, including:

- Definition of project goals

- Documentation of existing conditions

- Development of space or site program

- Advice on optimum use of available funds

- Early coordination during the design phase

- Value engineering

- Constructability reviews

- Control over the scope of work

- Optimum use of the design and construction firms' skills and talents

Benefits of P3s

Public-private partnerships help fill the void between typical annual government accounting and capital budgeting. The private markets know the benefits of capital budgeting and are investing heavily in U.S. capital infrastructure. Those who support the advancement of PPPs highlight many advantages. In a recent report by Deloitte titled, "Closing America's Infrastructure Gap: The Role of Public-Private Partnerships," it succinctly outlines six perceived benefits to governments utilizing PPPs as follows:

- PPPs allow the costs of investment to be spread over the lifetime of the asset and, therefore, allow infrastructure projects to be brought forward in years compared to the pay-as-you-go financing that is typical of many infrastructure projects.

- PPPs have a solid track record of on-time, on-budget delivery.

- PPPs transfer certain risks to the private sector and provide incentives for assets to be properly maintained.

- PPPs can lower the cost of infrastructure to the public entity by reducing both construction costs and overall life-cycle costs.

- Since satisfaction metrics can be built into the contract, PPPs encourage a strong customer service orientation.

- Because the destination, not the path, becomes the organizing theme around which a project is built, PPPs enable the private sector to focus on the outcome-based public value they are trying to create. 10

The merits of the points may be debatable, but they outline some of the key reasons governmental entities in the United States are interested in PPPs.

Keys to Successful Projects

- Create Institutional certainty

- Educate the public about PPPs

- Prioritize and screen projects

- Appoint senior government champions

- Create a clear decision making hierarchy

- Be an effective counterparty with sufficient resources and experience advisors

- Adopt standardized procurement practices

- Clear accountability and transparency of the procurement process

- Be prepared to provide credit support to projects

[1] (United States Government Accountability Office, 1999)

[2] (Top Ten Facts About PPPs, n.d.)